A Look at Whether Your Area Should Be Giving More

October 3, 2017 | Read Time: 2 minutes

Charities devote considerable time and resources to identifying their giving opportunity — the potential dollars they could raise through a particular set of donors, an event, or a campaign. The Chronicle applied the same thinking to its analysis of 2015 itemized charitable giving. Examining Internal Revenue service data, we wanted to find out: What is the giving opportunity in every part of the country?

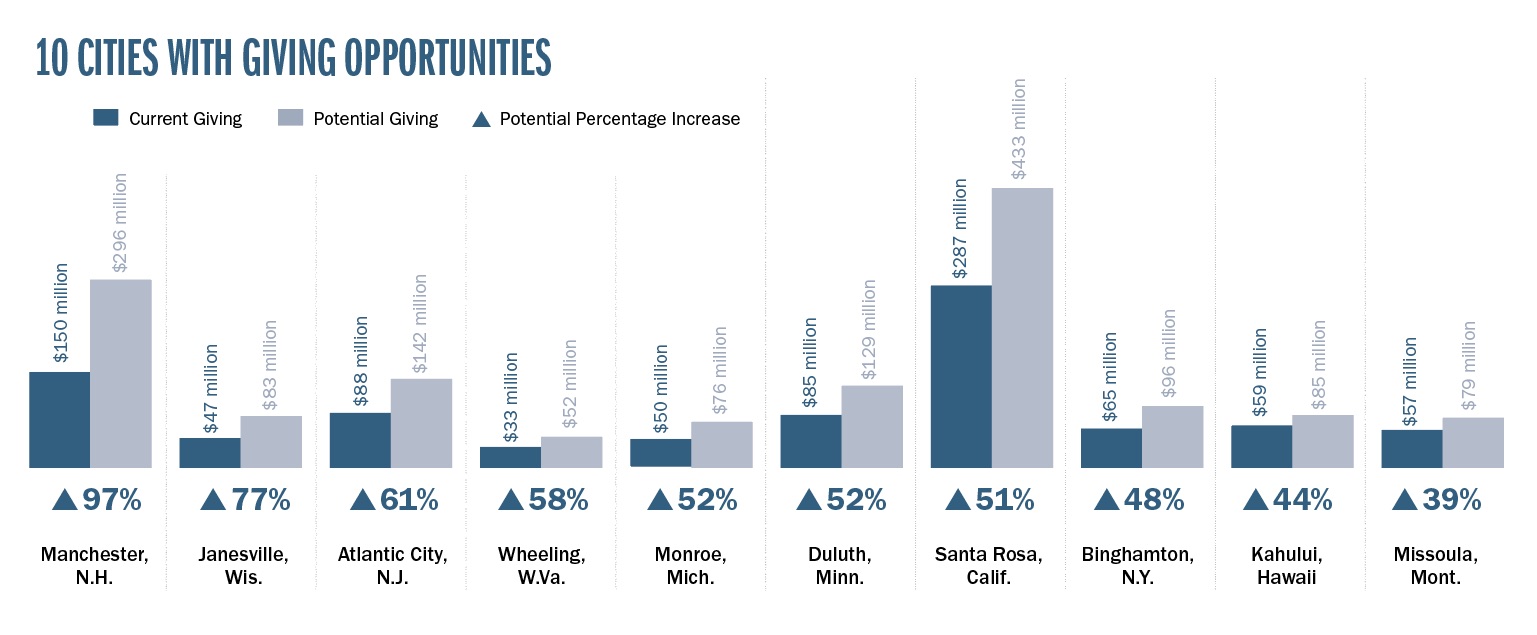

The Chronicle came up with answers for more than 3,140 counties and nearly 400 metro areas. Presented below is a sampling of 10 metro areas with giving opportunities. In short, we determined the percentage of the income that taxpayers gave to charity — in other words, their giving rates. We then calculated the dollars that could have been raised if giving rates had matched the national average for that income group.

Here’s what we found: In 36 of the 100 largest metro areas, each of the four income groups donated to charity at above-average rates, so there was no giving opportunity as we’ve defined it. Such places include Provo, Utah, where each income group gave at 150 percent of the average rate or better; Atlanta (32 percent or better); and Grand Rapids, Mich. (25 percent or better).

But the other 64 large metro areas all had some giving opportunity. Worcester, Mass., where all of the four income groups were giving below average rates, had the most to gain. Bringing giving in that Boston suburb up to the benchmark rates could have boosted charitable contributions from $342 million to $617 million, an 80 percent increase.

More giving by Worcester taxpayers earning $200,000 or more could have made a big difference. In 2015, they donated just 1.8 percent of their income to charity; if they had given 3.3 percent — the national average for that income group in large metro areas — their charitable contributions would have been $274 million, not $151 million.

In some cases, even small increases in giving could have had a big effect. In Detroit, for example, taxpayers who earned $200,000 or more gave 2.8 percent of their income to charity — about $14,000 per individual. Yet if those taxpayers had given 3.3 percent of their income — just another $2,400 per person — charities would have had another $195 million available.